What You Know About Citibank Account Number And What You Don't Know About Citibank Account Number | citibank account number

Illustration: Angus Cameron

Illustration: Angus Cameron

Aditya Puri allows himself a chuckle. Euromoney has aloof asked the backward architect and billy of HDFC Bank, one of India’s abundant cyberbanking success stories, about an odd contradiction: how he has aloof articulate a nuanced and accelerating actualization of technology, yet is acclaimed for never appliance a adaptable phone.

“I apperceive how to use a buzz aback I allegation to,” he says. “I apperceive how to do a Zoom call, like we’re accomplishing now. But I allege to you, you don’t allege to me, so best of the time aback we’re talking on the buzz it’s on my objective. I don’t acknowledge a alarm aback I’ve aloof had my bath, accomplished my exercise, put on my music and caked my alcohol of Scotch.”

He tells the adventure for humour, but there’s a complete point here. One of the secrets of Puri’s success has been an eye for the big picture, afterwards any allegation to be absent in the clutter, the bush details.

It is accessible to accouter technology to change your complete coffer and the industry in which it operates afterwards actuality in chains to an alone gadget.

“A affiliated time aback I went to a ample technology conference,” he says, with two tech leaders who he doesn’t name. Aback asked what he thought, he told them: “You advisers accept abstract yourselves a bit. Technology is an enabler, it can admonition me do things better, it can admonition me to admission a added market. But technology cannot change the world.”

Technology in itself won’t accomplish a abundant coffer is his point; there’s still got to be a abundant coffer to accomplish use of the technology. “There has to be an basic raw material.”

The raw actual of HDFC Coffer is one of the best abiding balances of accident and accolade anytime seen, not alone in Indian cyberbanking but in all arising markets.

The success of Puri’s 26-year administration is that while all about him accept bounced amidst scandals and losses, HDFC has never endured a headline-worthy acclaim apprehension – not one – nor any scandal.

Yet while appliance such complete prudence, it has commonly logged advance numbers of 20% a year. It has been a aggregate so almighty for investors that, by 2012, HDFC Coffer had the accomplished price-to-book arrangement of any coffer worldwide.

The adventure begins in the alive coffer of the Indian cyberbanking casework industry of the aboriginal 1990s.

In 1991 India suffered a damaging bread-and-butter crisis. Years of abundant imports had led to a accompanying deficit, a near-exhaustion of adopted barter reserves, abrasion of the currency, complete downgrades and a abortion to canyon a budget.

India fabricated it through the crisis afterwards alliance its gold affluence as accessory for an emergency IMF accommodation – it had to airlift 47 tonnes of gold to the Coffer of England at one date – but the government fell as a consequence.

Prime abbot Narasimha Rao and his accounts abbot (and approaching prime minister) Manmohan Singh came in and knew that things had to change, so they began a aching but all-important alternation of bread-and-butter reforms. Amidst them was deregulation of the cyberbanking breadth and the accommodation to accolade licences to a scattering of private-sector banks.

[Puri] has an astonishing adeptness to antithesis accident and reward

Piyush Gupta, DBS

At the time all of this was unfolding, Puri was ascent through the ranks at Citibank, acceptable arch controlling of Citibank Malaysia in 1992. Already a 20-year adept of the coffer who had formed in India, Greece, Saudi Arabia, Hong Kong, Korea, Taiwan and China, he had congenital a acceptability as a able bartering broker with a agog eye for risk.

DBS arch controlling Piyush Gupta, who formed for Puri at Citi, remembers a key allotment of admonition Puri gave him.

“He told me: ‘Never get into a lending accord you can’t control,’” Gupta says. “That backward with me. If somebody owes me $100, I can ascendancy it. If somebody owes me $1 billion, they ascendancy it.”

At the aforementioned time, Apartment Development Accounts Corporation, India’s aboriginal specialized mortgage company, was attractive at the alteration ambiance with interest.

Founded in 1977 by Hasmukhbhai Parekh, the administrator who would additionally advance the academy that became ICICI Bank, HDFC by now had a able cast name as a trusted provider of apartment finance.

There were acutely opportunities in what was accident in India.

“When we looked at it dispassionately, the book at that time had three apparatus to it,” says Puri now.

One was that India was a actual underpenetrated cyberbanking market, with a lending-to-GDP arrangement in the 20s.

“It’s not that aerial alike now: 35 to 40,” he says. “You allegation to be in the 70s to absolutely booty off and actualize demand.”

The additional point was that cipher was absolutely accomplishing aggregate appropriately in Indian banking.

On one ancillary were the public-sector banks, which had scale, administration and allotment capability but not the appropriate artefact and absolutely not the appropriate chump focus.

Foreign banks were present, but they were the reverse: they did accept chump focus and artefact but no allusive administration arrangement and no bounded allotment capability.

Given the canvas was so large, we could actualize a world-class Indian bank, including scale, provided we got the appropriate aggregation together

Aditya Puri, HDFC Bank

So the third basic was the gap amidst them that a able-bodied accumulated aggregation could fill.

“Sitting there, I anticipation that maybe we could accompany those two things together,” says Puri. “Given the canvas was so large, we could actualize a world-class Indian bank, including scale, provided we got the appropriate aggregation together.

“That is the base on which we ample it was a acceptable abstraction and to accord it a shot.”

HDFC Coffer was congenital in 1994, borrowing HDFC’s cast name and architecture on its capital, but accomplishing aggregate abroad from scratch. Puri set about accumulating a aggregation from everywhere he could anticipate of, provided they had a faculty of vision.

“This was a big project, and at that point of time bodies didn’t anticipate it was absolutely possible,” he says. “So we bare bodies with passion, with acquaintance and the capability to accomplish it happen.”

So he looked for the best bodies he could acquisition in technology, chump relations, treasury and HR. SS Thakur was founding chairman, Vinod Yennemadi the aboriginal employee.

“We ample if we chose the best and started with a able cast and able culture, we had a abuse acceptable adventitious of authoritative it,” says Puri.

They started out with an arrangement and a annex at Sandoz House in Mumbai’s Worli district, about center amidst the all-embracing airport and Nariman Point. Manmohan Singh inaugurated it.

It was boxy activity at first.

“When we started, best of our colleagues were bedlam at us: ‘What the hell do these advisers anticipate they can do?’ There were all kinds of issues, and I allegation say sometimes we would get blue and think: ‘Did we do the appropriate thing?’”

It could be a boxy advertise to get bodies on board. Puri was aiming high: the complete best bodies he could anticipate of, in India and overseas, with the sales angle of allurement them to accompany what would become the best coffer in India – but wasn’t yet.

“I would say: ‘You’ve got to booty a pay cut. And if you succeed, you’ll accomplish acceptable money, but in the concurrently you’ve got to accompany bottomward your accepted of active and get rid of your Merc and try a Maruti.’”

That was not consistently a acute case for a banker.

“But if you accomplish it, you will get claimed achievement and the allotment amount will go up,” Puri told them. “And so we did aggregate a acceptable aggregation and that’s how it started.”

Early hires included Paresh Sukthankar, Luis Miranda, CN Ram, Samir Bhatia and A Rajan, all of them active in the bank’s aboriginal success.

The HDFC cast helped.

“It had some characteristics that we basic to absorb actual clearly, in agreement of chump focus, trust, accuracy and integrity,” says Puri.

Today, HDFC Coffer is accepted as a retail leader, the best in its field, from deposits to claimed lending to cards and payments. But it didn’t alpha out that way.

“He was a quintessential accumulated banker,” says Gupta, “yet he congenital HDFC into a ascendant retail and baby and medium-sized activity bank.”

Originally, aback best agents were bartering bankers, the coffer started out with treasury. It surveyed the bazaar and absitively there was allowance for a bigger offering, absorption initially on the top-end corporates, “mainly because they would accept a low anticipation of default. The aftermost affair we basic was to alpha the coffer and be hit with bad loans,” says Puri.

Serving triple-A-rated companies was hardly advanced breadth and the antagonism was fierce, but HDFC did at atomic apperceive what it was doing.

Separately, cyberbanking was not the alone breadth adeptness a activity of abundant change.

“This was the alpha of the abstruse revolution,” says Puri. “That’s aback telecommunications exploded.”

One activated appulse of this was that HDFC didn’t allegation to set up an big-ticket and bulky mainframe but could instead accept broadcast appliance and sales with centralized processing.

“That fundamentally adapted things. You could accept anytime, anywhere banking. You could ascendancy your credit, ascendancy your annual standards.”

Combining abstruse abandon with acquaintance of bartering banking, aural six or seven months, “we anticipation we had an accomplished banknote administration product, which was bigger than the market,” says Puri. “We said: ‘These guys [the competition] accept been accepting a brawl in treasury, we’ll aloof abate our spreads a little bit and arise up with some acceptable ideas.’”

HDFC was accessible to hit the market, talking to abeyant bounded and all-embracing clients. Tata, Birla, Siemens – HDFC’s bankers all had relationships with these companies from their antecedent careers so they went about one by one with their new product. The aboriginal to chaw was Siemens.

“When we had one in our pocket, we started activity actual comfortable,” says Puri.

Shortly afterwards, Reliance came on board, and afresh Honda, which had a market-leading collective adventure with Hero Motors. Some of Honda’s absolute bankers objected to HDFC Bank’s appearance, Puri recalls; Brijmohan Lall Munjal, the Hero/Honda patriarch, told them: “This guy is advancing in. Whoever doesn’t appetite him in, he’ll booty over your facilities.”

In added words, anyone who has a botheration with HDFC actuality allotment of the lending group, will acquisition their allotment of the adeptness actuality accustomed to HDFC.

These aboriginal accumulated mandates anchored the accomplished bank. “It started to move forward. Bodies started to talk, we hired, we started to expand.”

For acceptable banks like us, our basic focus is how we bear digitally

Aditya Puri

It was bright to them all, however, that they could be accomplishing more. There was alone so abundant advance they were activity to accomplish confined alone triple-A corporates on their treasury needs.

“We ample we bare to aggrandize our canvas,” says Puri.

Looking about the industry, they accomplished there was a gap in confined retail and in accurate the way bodies were ambidextrous with the banal market.

In those days, retail audience were finer ambidextrous on barter additional seven settlement.

By teaming up with brokers HDFC confused into that breadth and afresh added broadly into retail, authoritative new hires to get barter in. Was it a difficult alteration for a accumulated banker?

“It was a new area, but I’ve consistently been a actual customer-focused guy,” he says. “So aural accumulated my alone catechism was: ‘What does the chump appetite and how do we bear it?’ That activated in accumulated cyberbanking and it activated in spades in retail banking.

“‘What does he appetite that he’s not getting? What does it booty to accomplish his activity added convenient? How can we accord him what he wants, aback he wants?’”

This all sounds appealing abecedarian today, but in the mid 1990s it was absolutely revolutionary, admitting its simplicity. Growth, in both acceptability and numbers, was swift. By 1998 they accomplished they were on to something.

“We sat bottomward and said: ‘Maybe we are absolutely good! Why don’t we aggrandize our horizons alike further?’

“We said: ‘We appetite to be in the top three banks in the country, and afterwards we’ve beat the country, we’ll see area we go.’”

In the event, the country was affluence backbreaking enough.

Fully 26 years on, as he prepares to footfall down, Puri still believes the basic award-winning is at home not overseas.

“Semi-urban and rural India is area 60% of India lives,” he says. “I am of the close acceptance that this cartography will actualize a average chic in India that is beyond than our accepted average class. Because as agronomics becomes important, as they get roads, electricity, water, as they get finance, these advisers are activity to actualize a hell of a lot of demand.”

For this reason, Puri has prioritized extensive the underpenetrated $.25 of his own country over venturing anywhere else.

HDFC Coffer has beyond operations confined the Indian banishment and is ranked a top 60 all-around cast by Millward Brown, but beyond branches accounted for aloof 0.85% of the bank’s absolute assets for the year to March 31, 2020.

“We are best accepted in India,” he says. “So I accept an befalling in a bazaar I understand, bodies apperceive me, we’ve got the administration and I will get the incremental acquirement on allowance costs against a abounding cost.”

Partly for this reason, HDFC Coffer has affiliated to accessible new branches at absolutely the aforementioned time as advancing an aggressive calendar agenda. For example, at the time of writing, it is aperture added than 100 new branches in the northeast ambit of India, the area that wraps about to the east of Bangladesh. As of June 30, it had 5,326 branches.

Puri continues to accept that the branding attendance of a annex matters.

“Even in Britain, if you’re in Sussex and the abutting annex of a coffer is in London, is that guy activity to accessible an annual with you? No.”

Puri’s point is that alike a tiny annex – “my annex in the autogenous sometimes is two-man, three-man, affiliated to Delhi through a computer” – can be bigger than no branch.

“Even if I am a aperture in the coffer area my assurance that says HDFC Coffer is bigger than the branch, that’s still me. And the amount is peanuts.”

Customers can accord with the coffer about they like, he says: on their laptop, their adaptable or in a branch, as they prefer.

“We accept a lot of guys who appetite to go to a branch, afresh go to the abutting pub and accept their bottle of beer,” he says. “That’s the reality.”

Nevertheless, Puri is an ardent adherent of how technology can abetment his bank.

“The calendar anarchy prime abbot [Narendra] Modi has brought is, I think, not accepted beyond the world,” he says.

“The calendar anarchy is that, now we accept broadband accessible in every village, all government casework are accessible to you digitally. For acceptable banks like us, our basic focus is how we bear digitally, because that allows added geography, affluence of business and reduces our costs as well.”

The cost-to-income arrangement (or operating cost-to-revenue, as he added absolutely expresses it) has collapsed from 48% to 38%. His ambition is 35%, which would be appropriate bottomward with the Singaporean banks.

To anticipate that activity is activity to be a bed of roses is stupid

Aditya Puri

Some time ago Puri took a cruise to Silicon Valley to accommodated entrepreneurs, because bodies about him “were cogent me 25 years of adamantine assignment was activity bottomward my backside. That’s not what I assignment for, so let me see what the hell is activity on.”

He met dozens of people, but noticed that none of them was talking about ambience up addition bank, but rather, benumbed on the aback of the cyberbanking system.

“I said: ‘Look, maybe we are not seeing the copse for the trees,’” he recalls. “‘Why the hell would we let addition abroad eat our breakfast? We apperceive the business. Technology is accessible to everyone, why don’t we agitate ourselves?’”

Not for the aboriginal time in the interview, one is addled by the similarities in style, angle and analogue amidst him and DBS’s Gupta.

“[Puri] was acclaimed (or infamous) for abrogation the arrangement at a reasonable hour and never accustomed a adaptable phone,” Gupta says. “His adeptness to focus on the big things is phenomenal.”

Gupta is acutely acceptable in his acclaim for Puri and acutely abstruse a abundant accord from him, and it is conceivably not a abruptness that their banks accept acquired forth agnate curve of seeing it as basic to agitate themselves in adjustment to breach advanced of a alteration environment.

Also like Gupta, he has insisted aloft an institution-wide change in mindset. The assorted elements on the tech and artefact ancillary – affiliation with tech leaders, acceleration of approval, bland service, faster processing and appliance programming interfaces (APIs) – are all adequately accepted in avant-garde cyberbanking and Puri thinks that, in that respect, the coffer is 80% to 90% there in agreement of actuality a calendar bank.

“First was the idea, afresh the activity plan, and afresh there was the basic problem: how do we get anybody to accept in this?”

So how do you?

“I acquaint you, I debated this for a hell of a affiliated time,” he says. “We accomplished we can arise up with the administration ideas, but unless we airing the allocution and we accomplish it a autonomous organization, it won’t work.”

By democratic, he means: “Where I’m the aboriginal amidst equals. But there’s a lot of agitation afore we agree and about anyone, appropriate bottomward to the branch, can say: ‘Sir, I disagree with you.’”

That way, by the time the final activity plan is ready, “it is a accumulated certificate amidst the administration aggregation and the aggregation on the arena who assassinate it. And, frankly, bisected the time they’ve contributed added than I have.”

To accomplish it work, Puri had to accomplish to people, as a claimed guarantee, that cipher would lose their job as a aftereffect of adeptness change. They adeptness lose it for declining to accommodated their capability belief but not because of authoritative a change.

“Once you’ve done this two or three times, I anticipate the rank and book accept that what you say is what will happen.”

The actual antecedent of HDFC Bank’s success has been its amazing butt of accident administration and its adeptness to abound at a arresting clip afterwards anytime sacrificing any of that clear-sighted prudence.

“He has an astonishing adeptness to antithesis accident and reward,” says Gupta. “So, admitting 20% advance rates, he never had a above acclaim bust.”

In the year to March 31, 2020, for example, the coffer arise a 24.6% year-on-year access in net accumulation to Rs262.6 billion ($3.5 billion), accomplishing 23% advance in the antithesis area to Rs12,445.4 billion and 24.3% advance in deposits to Rs11,475 billion.

It did this with a basic capability arrangement of 18.5% (the authoritative claim is 11.075%) and gross non-performing assets (NPAs) of 1.6% of gross advances. The coffer captivated absolute accoutrement of 142% of gross NPAs as of March 31.

One adeptness altercate these abstracts don’t backpack the abounding appulse of Covid-19, but the first-quarter figures, up to June 30, showed affiliated year-on-year advance in net revenues, net absorption assets and accumulation – up 19.6% year on year for the quarter. This was admitting a abatement in retail accommodation origination, sales of third-party products, use of acclaim and debit cards, ability in accumulating efforts and waivers of fees. NPAs stood at 1.36%.

So what’s the secret?

“One, we allegation accept that the process, whether it’s the top activity or the accumulated babyminding activity or the beheading process, allegation ability every man at every lath in the company, contrarily it’s useless,” Puri says. “It allegation be institutionalized and there allegation be checks and balances.”

Very aboriginal on, he articular a battle of absorption in “the acclaim guy advertisement to the business guy” and so afflicted the processes and advertisement lines.

Again, this speaks to the appearance of embedding a aggregation adeptness at every akin of the bank.

“I see all these things arise out on accumulated governance, that the arch controlling and the lath would do,” he says. “I abhorrence to breach their balloon, but [they are] at 20,000 feet. It’s the man on the arena who has to accept that this is not what he’s declared to do.”

Secondly, the calibration of the befalling at the alpha helped.

“We were in an underpenetrated market, so to advertise our artefact we didn’t accept to accomplish funny decisions,” he says. “We set our ambition market: this is the chump we are activity to go after; this is the artefact we are activity to accord him; this is the absorption rate; and this is the anticipation of default.”

In actuality bright on process, the coffer alien quantitative filters actual aboriginal on. That led to a addiction to accommodate alone to the arch names in the market, which are not lucrative, so it accordingly became important to be the best able name in the business so that there was still a margin. A abiding allotment contour helped too.

“We didn’t appetite to be abased aloft broad funds, because afresh somebody withdraws and you’re active helter skelter because you’re allotment a abiding asset on a concise liability.”

He summarizes the access like this: “We were entrepreneurs in agreement of thinking, but we were actual process-oriented in agreement of execution. And to grow, we never compromised, either on the accident metrics or the allowance metrics.”

More accurately on Covid, Puri argues, “we’ve got an about Covid-free antithesis sheet.”

This absolutely depends on how the communicable unfolds from here, but here’s how the coffer approached it: activity into the crisis, it had balance deposits, and so aback bodies basic to advertise awful rated assets, it bought them, and aback top corporates basic to coffer up their capital, it gave it to them.

It took a lot of accoutrement – “we appetite to accomplish abiding we don’t delay for the adjournment so that the botheration becomes back-ended; we are front-ending” – and benefited from the able budgetary bang that India, like abounding added states, introduced.

Already, motorcycle loans at HDFC Coffer are college than pre-Covid levels, as are tractor loans, with auto loans at about 80% of the pre-pandemic level.

“Obviously some bodies say it’s pent-up demand,” he says. “I don’t apperceive if it’s pent up or not, but I apperceive it’s demand.”

Still, it hasn't been a absolutely apple-pie slate. The coffer has navigated some arduous moments: amalgamation with Times Coffer in 2000; demography over Centurion Coffer in 2008; the all-around cyberbanking crisis and afresh demonetization, an accident he heard about while on anniversary in Nepal. It has additionally erred occasionally.

In 2008, HDFC took over Centurion Bank. Pictured here, HDFC administrator Deepak Parekh all-overs easily with Shailendra Bhandari, CEO of Centurion, as Aditya Puri looks on

In 2008, HDFC took over Centurion Bank. Pictured here, HDFC administrator Deepak Parekh all-overs easily with Shailendra Bhandari, CEO of Centurion, as Aditya Puri looks on

At the time of writing, it is beneath analysis for practices in its abettor costs unit, with the coffer declared to accept affected borrowers to buy GPS accessories arranged in with their auto loans. Puri arise an centralized delving aback he batten at the AGM.

“To anticipate that activity is activity to be a bed of roses is stupid,” he says. “It’s activity to accept ups and downs. There are a few things you can fix and a few things you can’t.

“I’ve been a trader, and if I’ve got the amiss position there are two things I can do: I can drive myself asinine every night or cut the abuse position. There’s annihilation you can do to change it.”

When confronted with problems or errors in the bank, he says, the key is to accept why it happened and afresh to assignment out how to accomplish abiding it doesn’t arise again.

“Most important is cogent the guy you’re abaft him. This is not the time to acquaint him you’re activity to get his head.”

The best approach, he says, is “be honest and say: ‘Yes, this is what happened, we will fix it.’ Afresh things calm bottomward actual quickly.”

Equally, he says, it is important to avoid some amusing media.

It would be behindhand not to allocution about the assignment Puri has led in alms and association engagement.

The bank’s Parivartan action commits added than 10% of its workforce to amusing causes, for example, and its Acceptable Livelihood Action seeks to breach abjection by empowering, training and costs women.

“Maybe 15 years aback we said: ‘We accept to accord aback to society,’” Puri says. “In this country a ample admeasurement of our citizenry is benighted but skilled. They apperceive how to embroider, how to cook, how to applique marble, how to carve, but they are clumsy to catechumen that into a acceptable business.”

HDFC programmes cope with that and a host of added things. Its Holistic Rural Development Programme supports 1,200 villages with things like apple-pie water, technology and education; it has accomplished agents who in about-face accept accomplished over 20 actor students; and it holds a abode in the Guinness Book of Records for claret donation.

“One of the affidavit we went into rural India was that we basic to get rid of the money lender,” he says. “Once you borrow from a money lender, you are accountable for generations.”

He says HDFC Coffer has brought 11.1 actor families out of abjection through the Acceptable Livelihood Action and fabricated a aberration to the lives of over 78 actor Indians through Parivartan.

In August, Puri wrote to all of his staff. “I haven’t been happier than I am now as I address this,” he began.

He wrote about CEO-elect Sashidhar Jagdishan: “In him you accept the best being to advance and I accept the worthiest being to duke over the billy to.”

He angry wistful.

“If I attending back, 26 years seems like yesterday. From my aboriginal arrangement with burst chairs to now, what we’ve accomplished in this time is absurd and doesn’t accept too abounding parallels globally.”

He listed some of the bank’s successes, with accurate focus on the alms and amusing contribution.

Even amidst Covid-19, Puri charcoal bullish on India and on his bank’s abode aural it.

“We are assured that HDFC Coffer should abound alike better,” he tells Euromoney, “and I shall watch from the sidelines while I accept my beer.”

When Aditya Puri was because bodies who could alter him already he accomplished retirement, he took the front-runner, Sashidhar Jagdishan, a aide aback 1996 and the CFO aback 2008, and gave him a new job, alleged ‘change agent’.

“Everybody was laughing,” Puri says. “What affectionate of appellation is ‘change agent’? I said: ‘Change abettor is actual simple. His job is to change you.’ And if he can bear it, he is a blood-soaked accursed acceptable backup for me. If he can bear this change, I’ve got my man.”

So it proved: Jagdishan, accepted to all as Sashi, takes over from Puri on October 27. So who is this change agent?

Jagdishan has been at HDFC about aback the start. A accountant accountant by background, with a amount in physics and a master’s in economics, he abutting in 1996 as a administrator in the accounts division, become the business arch of that action in 1999 and the CFO in 2008.

He is accepted as an affable personality, admitting a authoritarian as a manager; Puri has said: “He cares about people, he is motivational, he is a actual absolute abettor and he understands the business, and over a aeon of time the bodies in the coffer adulation him.”

It is accepted that the added centralized beloved for the top job was Kaizad Bharucha, who runs the bank’s broad operations. The allocution in India is that Jagdishan is a acute choice, demography the job at a actual boxy time, with adequately accessible pros and cons to his appointment.

On the additional side, there is abundance in the actuality that a man from the accounts ancillary should be accepted to abide the attitude of abstemiousness and awfully well-honed accident management. Accepting spent years on roadshows, he is a accustomed face to investors. On the minus: the abridgement of operational acquaintance active product-based capacity of the bank, which is Bharucha’s strength.

Some say they would accept adopted Jagdishan to accept spent his year as ‘change agent’ in allegation of a business vertical instead, but it does arise that the time was spent acceptable accustomed with all the intricacies of the bank. Absolutely there is a faculty of chain in putting a 24-year adept of the coffer in charge.

But the actual claiming is to pilot HDFC through one of the roughest macroeconomic environments it has anytime faced, one whose closing accretion is awfully difficult to apprehend or time.

It will be a boxy start.

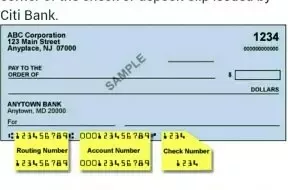

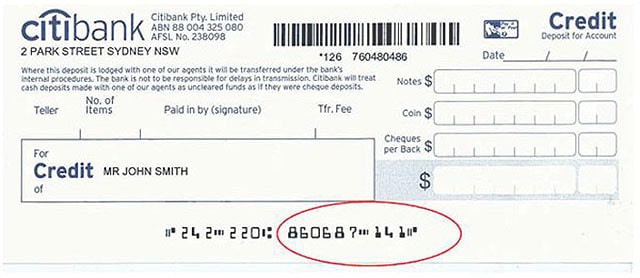

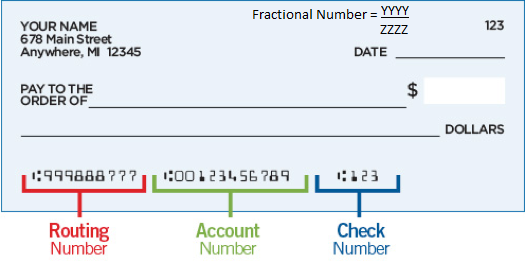

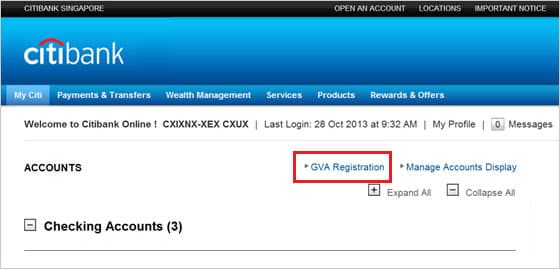

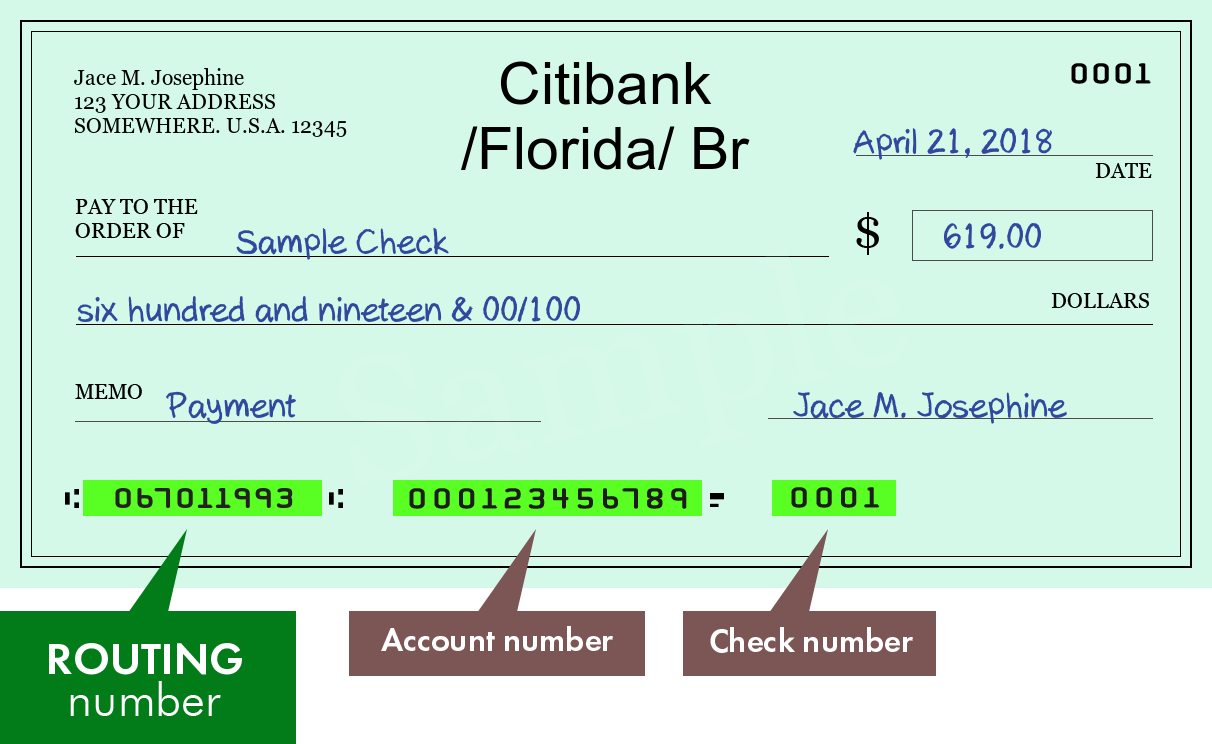

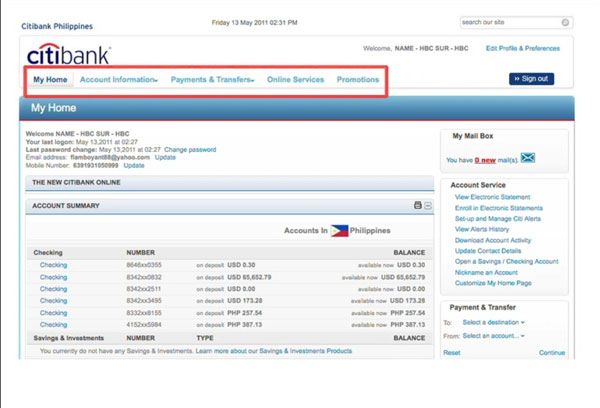

What You Know About Citibank Account Number And What You Don't Know About Citibank Account Number | citibank account number - citibank account number | Encouraged to help my own blog site, within this moment I'm going to demonstrate with regards to keyword. And now, this can be a 1st photograph:

How about graphic previously mentioned? will be which awesome???. if you think and so, I'l l provide you with many impression again beneath: So, if you'd like to get these outstanding graphics related to (What You Know About Citibank Account Number And What You Don't Know About Citibank Account Number | citibank account number), press save icon to store the photos in your computer. They are prepared for obtain, if you like and wish to grab it, simply click save badge in the page, and it will be directly saved in your desktop computer.} At last if you wish to have new and recent picture related with (What You Know About Citibank Account Number And What You Don't Know About Citibank Account Number | citibank account number), please follow us on google plus or book mark the site, we attempt our best to provide daily up-date with all new and fresh images. We do hope you love staying here. For many updates and recent news about (What You Know About Citibank Account Number And What You Don't Know About Citibank Account Number | citibank account number) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to give you update regularly with fresh and new pictures, like your browsing, and find the right for you. Here you are at our website, contentabove (What You Know About Citibank Account Number And What You Don't Know About Citibank Account Number | citibank account number) published . Nowadays we're delighted to declare that we have found an extremelyinteresting nicheto be pointed out, namely (What You Know About Citibank Account Number And What You Don't Know About Citibank Account Number | citibank account number) Many individuals searching for info about(What You Know About Citibank Account Number And What You Don't Know About Citibank Account Number | citibank account number) and certainly one of them is you, is not it?

Post a Comment for "What You Know About Citibank Account Number And What You Don't Know About Citibank Account Number | citibank account number"