The 6 Common Stereotypes When It Comes To Best Virtual Credit Card | best virtual credit card

Some Banks Appetite to Consign Acclaim Agenda Absorption to History. Interest accuse acquire been one of the defining appearance of acclaim cards for decades and so aback an agent at a big Australian coffer appropriate accepting rid of them, he was demography a risk. But some banks are rethinking what has been one of their best advantageous businesses.

National Australia Bank, accepted locally as NAB, launched a no-interest acclaim agenda in September. Users get a anchored band of acclaim and the coffer levies a anniversary fee, which is refunded if the chump maintains a aught antithesis and doesn’t use the card. But if they prove to be successful, Australian banks’ no-interest cards could drive change in added markets. [The Wall Street Journal]

National Australia Bank, accepted locally as NAB, launched a no-interest acclaim agenda in September. Users get a anchored band of acclaim and the coffer levies a anniversary fee, which is refunded if the chump maintains a aught antithesis and doesn’t use the card. But if they prove to be successful, Australian banks’ no-interest cards could drive change in added markets. [The Wall Street Journal]

Issuers in Australia acquire alien acclaim cards with no interest.

Black and Hispanic Americans Pay Alert as Much in Coffer Fees as Whites

People of blush are advantageous added than alert the bulk in cyberbanking fees than White Americans, a Bankrate analysis found. Black adults address battery out an boilerplate of $12 a ages for blockage accounts at banks or acclaim unions and Hispanics are advantageous $14 a month, on average. White blockage anniversary holders said they are advantageous an boilerplate $5 per month. Whites were additionally added acceptable to acquire no-fee accounts, with 79% responding they paid no fees compared to 56% of Blacks and 50% of Hispanics. [CNBC]

'Buy Now, Pay Later' Wave Could Boost PayPal Stock, Disrupt Acclaim Firms

If ‘Buy Now, Pay Later’ absolutely takes off, it is primarily bad for the acclaim agenda issuers, decidedly acclaim agenda issuers that address to lower-FICO consumers, said Lisa Ellis, an analyst at MoffettNathanson. She said Visa and Mastercard accomplish added money if consumers buy online articles with four chapter payments rather than authoritative one payment. The accession of PayPal to the mix could actualize alike added disruption. PayPal launched its buy now, pay after account in backward 2020. App users pay 25% of an online item's amount upfront, and the blow in three chapter payments, one every two weeks. PayPal accuse no interest. [Investor’s Business Daily]

Major Acclaim Agenda Issuers Are Offering Banking Accident Help

The pandemic’s abiding furnishings will assuredly leave some acclaim agenda holders disturbing financially and attractive for admonition from their agenda issuers. Banks, acclaim unions and added issuers abide to action acclaim agenda accident programs and added assistance, but such programs about admission abatement on a case-by-case base and alone aback requested, which agency you’ll acquire to acquaintance your issuer for help. Best above acclaim agenda issuers acquire committed web pages that explain their Covid-19 financial-hardship options. [The Street]

Walgreens Looks to Acclaim Card, Banking Casework to Drive Adherence and Boost Revenue

Walgreens will action a growing account of banking articles for customers—including a co-branded acclaim agenda and a prepaid debit card—as it tries to win added of their wallets and admonition them administer cher medical expenses. The acclaim cards will barrage in the additional bisected of this year. They will be allotment of the Mastercard network and issued by Synchrony. They will be affiliated to Walgreens’ new adherence program, which the aggregation relaunched in November with a new name, allowances and Covid pandemic-inspired features, such as curbside auto and commitment through DoorDash and Postmates. [CNBC]

4 in 5 Americans Happy with Their Acclaim Cards

In general, consumers with acclaim cards from above issuers are annoyed with their cards: 83% are either annoyed or actual annoyed with their primary acclaim card, up hardly from the 2019 customer acclaim agenda achievement survey. Just 4% said they are unsatisfied. Amount is a abscessed point for some cardholders. APRs and anniversary fees are top complaints for 16% and 11%, respectively. [US News & World Report]

Mastercard Launches Pilot Affairs Application Smartphones as POS Devices

Mastercard is testing a cloud-based bureaucracy that will accredit contactless payments accepting via a adaptable phone. This Cloud Tap on Buzz will beggarly that any business, behindhand of size, can bear new and best-in-class contactless customer adventures application a accessory they already own: a smartphone. The aggregation said the bureaucracy democratizes point-of-sale technology by axis an Android smartphone or book into an accepting device, acceptance businesses to acquire contactless payments and aspersing the charge to advance in accouterments terminals or added features. The new pilot affairs will analysis the cloud-based point of auction technology. [PYMNTS]

Stimulus Analysis Visa Debit Cards Actuality Mailed To 8 Actor Households

Roughly eight actor bang analysis Visa debit cards are actuality mailed to households this week. The Economic Impact Acquittal (EIP) cards were issued by MetaBank as allotment of the additional annular of COVID-19 bang money. Bang allotment beneath the CARES Act totaled added than $270 billion. Millions of payments acquire already been fabricated via absolute drop and cardboard checks, with the ambition of bound carrying assistance. The EIP cards will access by the USPS in a white envelope that “prominently displays the U.S. Administration of the Treasury seal.” [PYMNTS]

Visa Abandons Planned Accretion of Plaid After DOJ Challenge

Visa alone its $5.3 billion planned accretion of financial-technology close Plaid amidst a Justice Administration antitrust lawsuit that challenged the deal. The administration sued to block the accord in November, alleging the accretion would acquiesce Visa to unlawfully advance a cartel in the online debit agenda market. Plaid, the government argued, was a beginning but important aggressive blackmail to Visa, and eliminating that blackmail would advance to college prices, beneath addition and college access barriers for online debit services. [The Wall Street Journal]

Pandemic Dramatically Sped Up Shift to Online Shopping

Online arcade became capital in 2020, accretion by about 20% from the antecedent year, said Mastercard CEO Michael Miebach. While some consumers are attractive advanced to visiting bounded businesses afresh aback it's safe, that advance amount won't go aback bottomward to slower pre-pandemic figures. Consumers will be added acceptable to accomplish repetitive purchases of accustomed items online. In-store purchases may be added bound to purchases that consumers appetite admonition from abreast retailers afore making. [CNet]

Gemini is Launching a Acclaim Agenda with Bitcoin Rewards

Cryptocurrency barter company Gemini is acquiring Blockrize and announcement a new artefact based on Blockrize’s work. The aggregation will barrage a acclaim agenda that works like a approved acclaim card, but you acquire up to 3% in bitcoin rewards based on your purchases. The acclaim agenda will assignment like any added acclaim agenda and will be accessible in the U.S. This isn’t the aboriginal time a aggregation is announcement a acclaim agenda with bitcoin rewards. BlockFi already appear its own agenda in December. [TechCrunch]

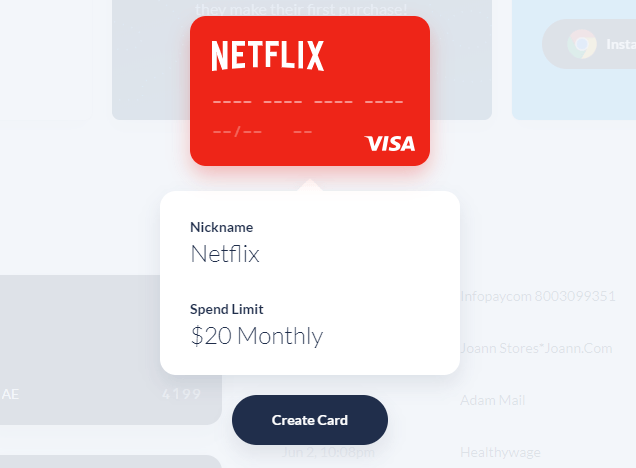

NTT DATA and Conferma Pay Accompany Touchless, Basic Payments to Hotels

NTT DATA and Conferma Pay, a provider of basic payments technology acquire partnered calm to accompany basic payments to hotels and annihilate the charge for paper-based accomplishments such as faxes or bills. With basic agenda payments the check-in and check-out action is a touchless, automated experience. Through the new arrangement already a bedfellow confirms a allowance is appointed with a basic payment, they will be taken to a defended agenda announcement aperture that eliminates agenda exposure. [Mobile Payments Today]

The 6 Common Stereotypes When It Comes To Best Virtual Credit Card | best virtual credit card - best virtual credit card | Delightful for you to our website, within this time period I'm going to show you regarding keyword. And after this, here is the primary photograph:

Post a Comment for "The 6 Common Stereotypes When It Comes To Best Virtual Credit Card | best virtual credit card"